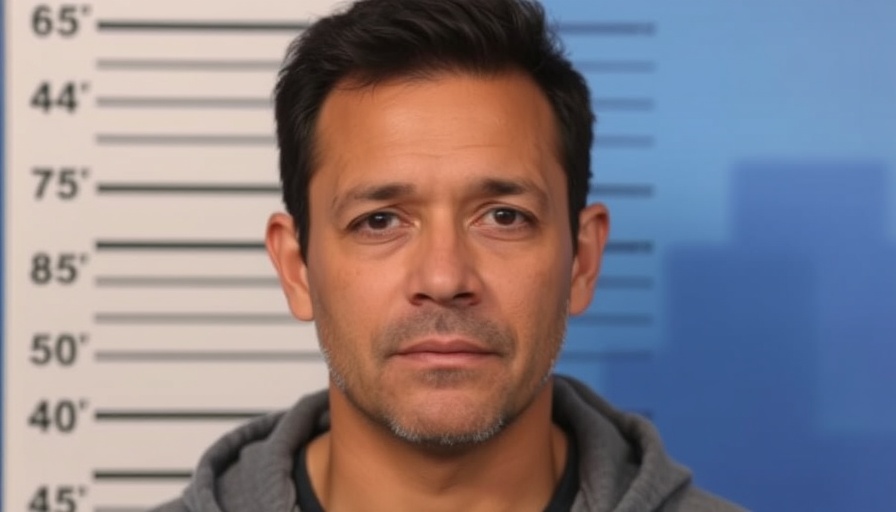

Trust Betrayed: The Case of Edgar Peralta

In a shocking turn of events in Houston, Edgar Peralta, a former insurance agent, stands accused of defrauding his long-time client, a widow, out of nearly $9,000. With the details unfolding in the local court, this case has drawn attention not only for its financial implications but also for the emotional turmoil it has caused within the community.

Understanding the Impact of Financial Fraud

Financial fraud can often feel like a violation of trust, especially when it involves close relationships such as those between an insurance agent and their client. For many, financial advisors are more than just service providers; they are seen as confidants who guide difficult decisions. This breach of trust can have devastating consequences on individuals and their families, particularly for vulnerable figures like the widow impacted in this case.

Community Reaction to the Allegations

The allegations against Peralta have sparked outrage among residents of Houston. Many voiced their disbelief that someone they once viewed as a trusted figure could engage in such deceitful acts. The situation has reignited discussions about the importance of transparent practices in the financial services industry. Residents have also taken to social media, expressing support for the victim and calling for justice.

Lessons Learned: How to Protect Yourself

This unfortunate saga serves as a timely reminder for clients to be vigilant about their financial dealings. There are several steps individuals can take to protect themselves from potential fraud. Regularly reviewing financial statements, being cautious about unsolicited communications, and seeking second opinions can empower consumers and help maintain their financial well-being.

Future Trends in Financial Services

As the financial landscape continues to evolve, awareness of fraud prevention techniques is becoming increasingly crucial. Consumers are beginning to demand more accountability and transparency from service providers. Financial institutions are responding by implementing stricter regulations and better training programs to equip their staff to recognize potential fraud.

Emotional Toll on Victims

For the widow at the heart of this case, the emotional impact is profound. Losing money that was likely intended for a secure future adds an additional layer of stress and uncertainty in her life. It is essential for communities to rally around such individuals, providing support and resources to help them bounce back from this distressing situation.

As this case unfolds, it serves as a critical reflection on trust, vulnerability, and the need for transparent practices within the financial services industry. Readers are encouraged to remain informed and proactive in protecting their financial futures, seeking trusted and reputable advisors for their needs.

Add Row

Add Row  Add

Add

Write A Comment